UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

☐ | | Preliminary Proxy Statement |

| |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

☒ | | Definitive Proxy Statement |

| |

☐ | | Definitive Additional Materials |

| |

☐ | | Soliciting Material Pursuant to § 240.14a-12 §240.14a-12 |

CITIZENS FINANCIAL GROUP, INC.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

☒

| |

| ☒ | | No fee required. |

| |

☐ | | $125 per Exchange Act Rules 0-11(c)(1)(ii), 14a-6(i)(1), 14a-6(i)(2) or Item 22(a)(2) of Schedule 14A.

|

| |

☐

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(4)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

☐

| |

| ☐ | | Fee paid previously with preliminary materialsmaterials. |

| |

☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

| | | | |

Notice of 2018

Annual Meeting

of Stockholders and

Proxy Statement

LETTER FROM THE CHAIRMAN AND CHIEF EXECUTIVE OFFICER

March 9, 20188, 2019

Dear Stockholder,

We recently completed our thirdfourth year as an an independent, publicly traded company with strong overall performance and I amgood achievement against our 2018 goals. We delivered strong positive operating leverage, hit key performance targets and added important new capabilities while making the strategic investments to drive success over the long-term. We continue to deliver well for all of our stakeholders and entered 2019 with good momentum.

On behalf of the Board of Directors, we are pleased to invite you to attend our annual meeting of stockholders to be held on Thursday, April 26, 2018,25, 2019, at 9:00 a.m. Eastern Time, at our headquarters located at One Citizens Plaza, Providence, Rhode Island 02903. You’ll find the matters scheduled for consideration at the meeting described in detail in the following 20182019 Notice of Annual Meeting of Stockholders and Proxy Statement. If you owned shares of our stock as of March 2, 2018,February 28, 2019, we encourage you to vote on these matters.

In order to accommodate those attending, we ask that you please mark your enclosed proxy card to let us know of your plans to attend. Registration and seating will begin at 8:00 a.m. Eastern Time and we will ask you to sign an admittance card and present valid photo identification. If you held your shares in a brokerage account please be sure to bring a copy of a brokerage statement that shows you held shares as of March 2, 2018.February 28, 2019. If you are the legal representative of a stockholder, please also bring proof thereof. Cameras and recording devices will not be permitted at the meeting.

We furnish our proxy materials to stockholders on the internet at www.edocumentview.com/CFG in order to provide you with the information you need in an expedited manner while significantly lowering the costs of delivery and reducing the environmental impact of our annual meeting. You will receive a notice with instructions for accessing the proxy materials and voting via the Internet in addition to information about how to obtain paper copies of our proxy materials if you would prefer.

Your vote is important and whether or not you plan to attend the meeting, we encourage you to access electronic voting via the Internet or utilize the automated telephone voting feature as described on your enclosed proxy card, or you may sign, date and return the proxy card in the envelope provided. You may also vote in person if you plan to attend the annual meeting.

On behalfFinally, we would like to thank Mr. Ryan and Mr. Di Iorio for their service as they both retire from our Board at the conclusion of the annual meeting. We appreciate their valuable insight and will miss their dedication and extensive contributions which have been instrumental to our board of directors, wejourney to sustainable growth since becoming a public company in 2014.

We thank you for your support of Citizens Financial Group, Inc.

|

Sincerely, |

|

|

|

|

Bruce Van Saun |

Chairman of the Board and Chief |

Executive Officer |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 26, 201825, 2019

To the Stockholders of Citizens Financial Group, Inc.:

NOTICE IS HEREBY GIVENthattheannualmeetingofstockholders(the“Annual (the “Annual Meeting”)of CitizensFinancialGroupInc.,aDelaware corporation(the“Company” (the “Company”),will beheldonApril 26, 2018,25, 2019, at9:00 a.m.EasternTime,attheCompany’sheadquarterslocatedatOneCitizensPlaza, Providence,RhodeIsland02903 forthefollowingpurposes:

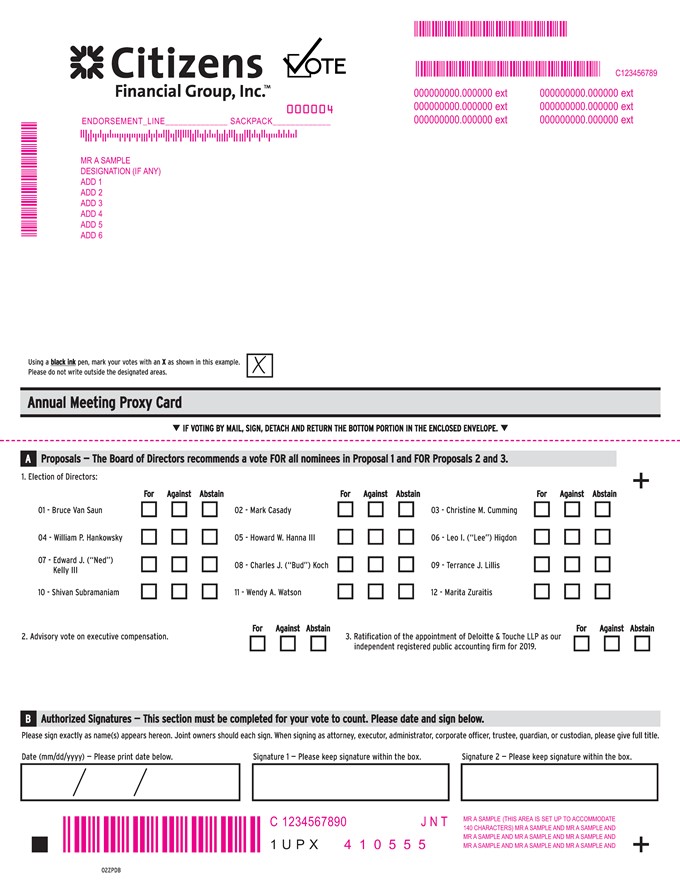

1. | The election of the twelve directors named in the accompanying proxy statement to serve until the 20192020 annual meeting or until their successors are duly elected and qualified; |

2. | Advisory vote to approve the Company’s executive compensation, commonly referred to as a “say-on-pay” vote; |

3. | Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal year 2018;2019; and |

4. | The transaction of such other business as may properly come before the Annual Meeting or any reconvened meeting following any adjournment or postponement thereof. |

Stockholders of record at the close of business on March 2, 2018February 28, 2019 are entitled to notice of, and to vote at, the Annual Meeting. We are first sending this proxy statement and the enclosed proxy formcard to stockholders on or about March 16, 2018.15, 2019.

Our board of directors recommends that you vote FOR the election of each of the director nominees named in Proposal No. 1 of the proxy statement, FOR, on an advisory basis, the Company’s executive compensation as described in Proposal No. 2 of the proxy statement,, and FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm as described in Proposal No. 3 of the proxy statement.

For our Annual Meeting, we have elected to use the Internet as the primary means of providing our proxy materials to stockholders. We will send to stockholders of record a Notice of Internet Availability of Proxy Materials (the “Notice”) with instructions for accessing the proxy materials, including our proxy statement and annual report, and for voting via the Internet. The Notice provides the information above and also provides information on how stockholders may obtain paper copies of our proxy materials free of charge. Electronic delivery of our proxy materials significantly reduces our printing and mailing costs and the environmental impact of circulating our proxy materials. The Notice also provides information on how to vote, including how to attend the meeting and vote in person.

i

Youare cordiallyinvitedtoattendtheAnnualMeeting,butwhetherornotyouexpecttoattendin person,youare urgedtomark,dateandsignyourproxycardandreturnitbymailorfollowthe alternativevotingproceduresdescribedintheNoticeortheproxycard.

|

BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

Robin S. Elkowitz |

Executive Vice President, Deputy |

General Counsel and Secretary |

Stamford, Connecticut

March 9, 20188, 2019

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on April 26, 2018:25, 2019:

This notice of the Annual Meeting of Stockholders, the accompanying proxy statement and our 20172018 annual report to stockholders will be available at www.edocumentview.com/CFG commencing on or about March 16, 2018.

15, 2019.

ii

TABLE OF CONTENTSTOPROXYSTATEMENT

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARY |

PROXY STATEMENT SUMMARY

PROXY STATEMENTSUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, andconsider; accordingly, you should read the entire proxy statement carefully before voting.

2019 ANNUAL MEETING INFORMATION

2018 ANNUAL MEETING INFORMATION

| | |

Date and Time: |

| April 26, 2018,25, 2019, at9:00 a.m.EasternTime. Time |

| |

Place: | | OneCitizensPlaza,Providence,RhodeIsland02903. 02903 |

| |

RecordDate: | March 2, 2018.

| February 28, 2019 |

| |

Voting: | | Holdersofcommonstockare entitledtoonevotepershare. share |

| |

Admission: | | Toattendthemeetinginpersonyouwill needproofofyourstockownership asoftherecorddateandaformofgovernment-issuedphotoidentification. If you are the legal representative of a stockholder, you must also bring a letter from the stockholder certifying (a) the beneficial ownership you represent and (b) your status as a legal representative. We will determine in our sole discretion whether the letter presented for admission meets the above requirements. |

| |

Date ofMailing: | | ANoticeofInternetAvailabilityofProxy Materials (the“Notice” “Notice”)orthis proxystatementisfirstbeingmailedtostockholdersonoraboutMarch 16, 2018.15, 2019. |

MATTERS TO BE VOTED ON AT THE 20182019 ANNUAL MEETING

| | | | |

PROPOSAL | BOARD VOTE RECOMMENDATION | REASON FOR VOTE RECOMMENDATION | PAGE |

1. | Elect the following nominees as directors: Bruce Van Saun, Mark Casady, Christine M. Cumming, Anthony Di lorio, William P. Hankowsky, Howard W. Hanna III, Leo I. (“Lee”) Higdon, Charles J. (“Bud”) Koch, Arthur F. Ryan, Shivan S. Subramaniam, Wendy A. Watson and Marita Zuraitis. | FOR ALL | Our Board believes that its directors represent an appropriate mix of experience and skills relevant to the size and nature of our business. | 8 |

2. | Approve, on a non-binding, advisory basis, the compensation of the Company’s executive officers named in the 2017 Summary Compensation Table, as disclosed in the Compensation Discussion and Analysis, the compensation tables and accompanying narrative. | FOR | Our Board believes the executive compensation closely aligns the interests of our named executive officers and the interests of our stockholders. | 29 |

3. | Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the 2018 fiscal year. | FOR | Based on its most recent evaluation, the Audit Committee believes it is in the best interests of the Company and its stockholders to retain Deloitte & Touche LLP. | 62 |

| | | | | | | | |

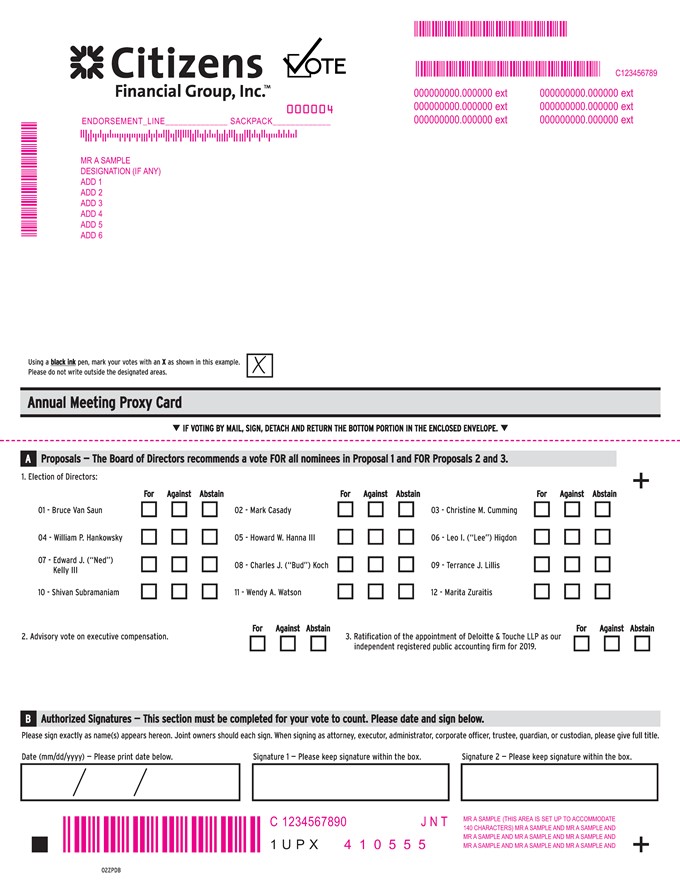

PROPOSAL | | BOARD VOTE

RECOMMENDATION | | REASON FOR VOTE RECOMMENDATION | | PAGE |

1. | | Elect the following nominees as directors: Bruce Van Saun, Mark Casady, Christine M. Cumming, William P. Hankowsky, Howard W. Hanna III, Leo I. (“Lee”) Higdon, Edward J. (“Ned”) Kelly III, Charles J. (“Bud”) Koch, Terrance J. Lillis, Shivan Subramaniam, Wendy A. Watson and Marita Zuraitis. | | FOR ALL | | Our Board believes that its directors represent an appropriate mix of experience and skills relevant to the size and nature of our business. | | 8 |

| | | | | |

2. | | Approve, on a non-binding, advisory basis, the compensation of the Company’s executive officers named in the2018 Summary Compensation Table, as disclosed in the Compensation Discussion and Analysis, the compensation tables and accompanying narrative. | | FOR | | Our Board believes our executive compensation closely aligns the interests of our named executive officers and the interests of our stockholders. | | 30 |

| | | | | |

3. | | Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the 2019 fiscal year. | | FOR | | Based on its most recent evaluation, the Audit Committee believes it is in the best interests of the Company and its stockholders to retain Deloitte & Touche LLP. | | 67 |

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARY |

HOW TOVOTE

Stockholders of record may vote by using the Internet, ortelephone, by mail (if you received a proxy card by mail) by mailor in person as described below.

| | | | | | | | | | | | |

| | | |

| | | |

| | | |

|

Internet | | | | Using the Internet.TheaddressofthewebsiteforInternetvotingcanbe foundonyourproxycardorNotice.Internetvotingisavailable24 hoursadayandwill be accessibleuntil11:59 p.m.EasternTimeonApril25,2018. Easy-to-followinstructions allowyoutovoteyoursharesandconfirmthatyourinstructionshavebeenproperly recorded.Telephone

|

| | | By telephone.Dial thenumberlistedonyourproxycardoryourvoting instructionform.Youwill needthecontrolnumberincludedonyourproxycardorvoting instructionform.Mail

|

| | | By mail.If youreceivedaproxycardbymailandchoosetovotebymail, simplymark yourproxycard,dateandsignit,andreturnitinthepostage-paidenvelope.In Person

|

| In person. Stockholdersalsomay attendThe address of themeeting website for Internet voting can be found on your proxy card or Notice. Internet voting is available 24 hours a day andvoteinperson. will be accessible until 11:59 p.m. Eastern Time on April 24, 2019.

| | | | Dial the number listed on your proxy card or your Notice. You will need the control number included on your proxy card or voting instruction form. | | | | If you received a proxy card by mail and choose to vote by mail, simply mark your proxy card, date and sign it, and return it in the postage-paid envelope. | | | | Stockholders also may attend the meeting and vote in person. |

If you hold shares through a bank or broker, please refer to your proxy card, Notice or other information forwarded by your bank or broker to see which voting options are available to you.

The method you use to vote will not limit your right to vote at the Annual Meeting if you decide to attend in person. Written ballots will be passed out to anyone who wants to vote at the Annual Meeting. If you hold your shares in “street name” you must obtain a proxy, executed in your favor, from the holder of record to be able to vote in person at the Annual Meeting.

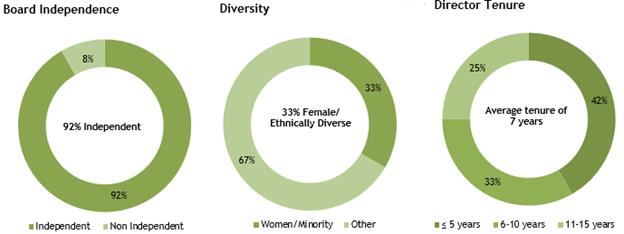

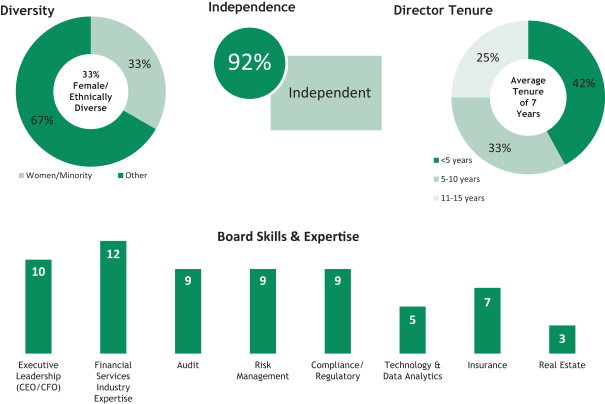

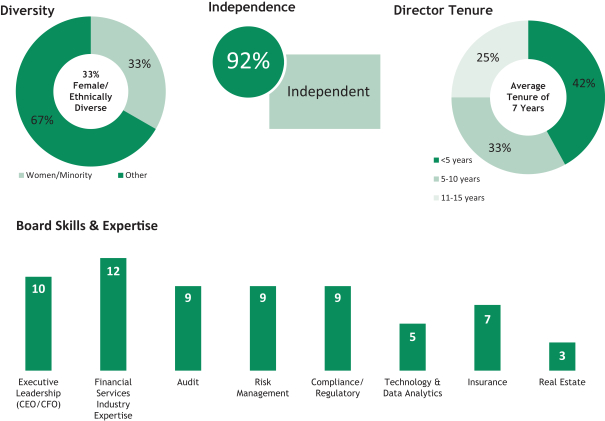

BOARD AND GOVERNANCE HIGHLIGHTS

Our board of directors (the “Board”) will consist of not less than 5five nor more than 25twenty-five directors, excluding any directors elected by holders of preferred stock pursuant to provisions applicable only in the case of defaults under the terms of our preferred stock. The exact number of directors will be fixed from time to time by resolution of our Board. Citizens Financial Group, Inc. (the “Company” or “we” or “us” or “our”) currently has twelvefourteen directors. The current terms of office of all directors expire at the Annual Meeting.

Twelve of the fourteen directors currently serving are standing for election at the Annual Meeting. Mr. Anthony Di Iorio and Mr. Arthur Ryan are retiring from the Board as of the Annual Meeting in accordance with the mandatory retirement provisions in our Corporate Governance Guidelines and as a result were not nominated by the Board for re-election at the Annual Meeting. The size of the Board, which was temporarily increased and is currently set at fourteen, will be reduced back to twelve upon the conclusion of the Annual Meeting.

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARY |

Thenomineesfordirector all currently serve on our Board and are asfollows:

| | | | | |

Name | Age | Director Since | Occupation | Board Committees | Independent1 |

Bruce Van Saun | 60 | 2013 | Chairman and CEO, Citizens Financial | Executive (Chair) Equity | No |

| | | Group, Inc. | | |

Mark Casady | 57 | 2014 | Retired Chairman and CEO, LPL Financial | Risk | Yes |

| | | Holdings, Inc. | | |

Christine M. Cumming | 65 | 2015 | Retired First Vice | Risk | Yes |

| | | President and COO, Federal Reserve | | |

| | | Bank of New York | | |

Anthony Di Iorio | 74 | 2014 | Retired CFO, | Audit | Yes |

| | | Deutsche Bank AG | Governance | |

William P. Hankowsky | 66 | 2006 | Chairman, President and | Audit | Yes |

| | | CEO, Liberty Property Trust | Compensation | |

Howard W. Hanna III | 70 | 2009 | Chairman and CEO, | Audit | Yes |

| | | Hanna Holdings, Inc. | Governance | |

Leo I. (“Lee”) Higdon | 71 | 2014 | Past President, | Audit | Yes |

| | | Connecticut College | Compensation | |

Charles J. (“Bud”) Koch | 71 | 2004 | Retired Chairman, President and CEO, | Risk (Chair) Audit | Yes |

| | | Charter One Bank | | |

Arthur F. Ryan | 75 | 2009 | Retired Chairman, CEO and President, Prudential Financial, Inc. | Compensation (Chair) Governance Executive | Yes |

Shivan S. Subramaniam | 69 | 2005 | Retired Chairman, FM Global | Governance (Chair) Risk Executive | Yes |

Wendy A. Watson | 69 | 2010 | Former Executive Vice | Audit (Chair) | Yes |

| | | President, Global Services, State Street | Compensation Risk | |

| | | Bank & Trust Company | | |

Marita Zuraitis | 57 | 2011 | Director, President and CEO, The Horace | Risk | Yes |

| | | Mann Companies | | |

| | | | | | | | | | | | | | |

| Name | | Age | | | Director

Since | | | Occupation | | Board Committees | | Independent1 |

Bruce Van Saun | | | 61 | | | | 2013 | | | Chairman and CEO, Citizens Financial Group, Inc. | | Executive (Chair) Equity | | No |

Mark Casady | | | 58 | | | | 2014 | | | Retired Chairman and CEO, LPL Financial Holdings, Inc. | | Risk | | Yes |

Christine M. Cumming | | | 66 | | | | 2015 | | | Retired First Vice President and COO, Federal Reserve Bank of New York | | Risk | | Yes |

William P. Hankowsky | | | 67 | | | | 2006 | | | Chairman, President and CEO, Liberty Property Trust | | Audit Compensation | | Yes |

Howard W. Hanna III | | | 71 | | | | 2009 | | | Chairman and CEO, Hanna Holdings, Inc. | | Audit Governance | | Yes |

Leo I. (“Lee”) Higdon | | | 72 | | | | 2014 | | | Past President, Connecticut College | | Audit Compensation | | Yes |

Edward J. (“Ned”) Kelly III | | | 65 | | | | 2019 | | | Former Chairman, Institutional Clients Group, Citigroup, Inc. | | Compensation Governance | | Yes |

Charles J. (“Bud”) Koch | | | 72 | | | | 2004 | | | Retired Chairman, President and CEO, Charter One Financial | | Risk (Chair) Audit | | Yes |

Terrance J. Lillis | | | 66 | | | | 2019 | | | Retired CFO, Principal Financial Group, Inc. | | Audit | | Yes |

Shivan Subramaniam | | | 70 | | | | 2005 | | | Retired Chairman and CEO, FM Global | | Governance (Chair) Risk Executive | | Yes |

Wendy A. Watson | | | 70 | | | | 2010 | | | Retired Executive Vice President, Global Services, State Street Bank & Trust Company | | Audit (Chair) Compensation Risk | | Yes |

Marita Zuraitis | | | 58 | | | | 2011 | | | Director, President and CEO, The Horace Mann Companies | | Risk | | Yes |

Additional information about the director nominees can be found beginning on page 9.

| 1 | Under applicable NYSE and SEC independence standards. |

2019 | 1

| UnderCITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARYNYSEandSECindependencestandards.

|

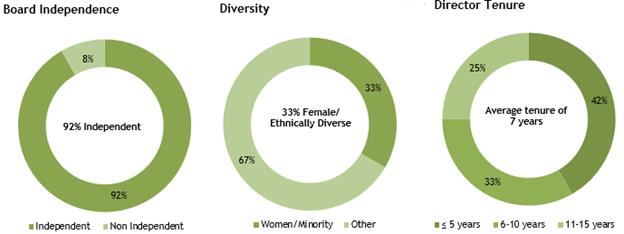

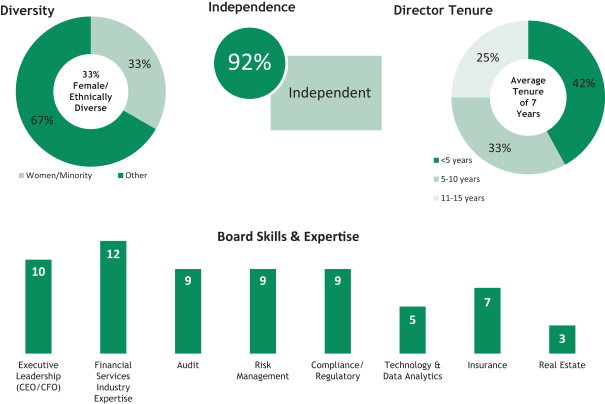

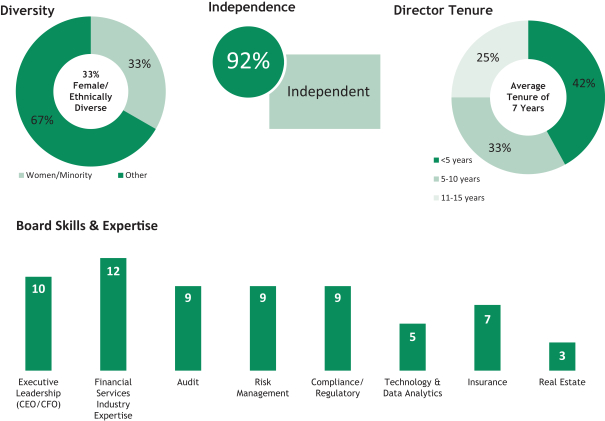

Webelievethatourdirectorsrepresent anappropriate and diverse mixofexperience andskills relevanttothesizeandnatureofourbusiness. The following key facts reflect the composition, skills and experience of the Board following the retirement of Mr. Di Iorio and Mr. Ryan effective at the conclusion of the 2019 Annual Meeting.

|

Board Composition and Skills Matrix |

| | | | | | |

| Board and Governance Key Facts |

| | | |

Size of Board Skills and Expertise | | 12* | | Classified Board | | No |

| | | |

✓ CEO experience

✓ CFO experience

✓ Retail Banking

✓ Financial Services Industry

✓ Finance/Capital Management

✓ Risk ManagementNumber of Independent Directors

| ✓ Compliance/Regulatory

✓ Technology

✓ Data Analytics

✓ Insurance

✓ Real Estate

✓ Academia

| 11* | | Lead Independent Director | | Yes |

| | | |

Board and Governance Key Facts |

Size of BoardMeetings Held in 2018

| 12

| Classified Board

10 | No

|

Number of Independent Directors

| 11

| Lead Independent Director

| Yes

|

Board meetings held in 2017

| 10

| Majority Voting for Directors | | Yes |

| | | |

Director Election Term (years) | 1

| 1 | | Tenure Limits | | No |

| | | |

Average Director Age | 67

| 66* | | Key Committees Independent** | | ✓ |

| | | |

Mandatory Retirement Age Policy | Yes

|

✓ | | Annual Board & Committee Evaluation | | ✓ |

| | | |

| Limit Service on Other Public Company Boards | | ✓ | | Board Orientation & Continuing Education Program | Yes

| ✓ |

| | | |

| Executive Sessions of Independent Directors | Yes

| ✓ | | Succession Planning Process | | ✓ |

Board Orientation & Continuing Education Program

| Yes

| Limit service on other public company boards

| Yes

|

Stock Ownership Guidelines | Yes

| Succession Planning Process

✓ | Yes

| Board Oversight of Strategy | | ✓ |

| | | |

Stockholder Outreach Program | Yes

| ✓ | | Diversity & Inclusion Program | Yes

| ✓ |

| | | |

Corporate Responsibility Reporting | | ✓ | | Political Contributions Policy | | ✓ |

* Effective upon conclusion of the Annual Meeting. The board size was temporarily increased to fourteen effective February 2019 to accommodate the addition of Mr. Lillis and Mr. Kelly prior to the retirement of Mr. Ryan and Mr. Di Iorio following the Annual Meeting.

** Audit, Risk, Compensation and Human Resources and Nominating and Corporate Governance Committees are comprised of independent directors.

2019 | Yes

| | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARY |

PERFORMANCE HIGHLIGHTS – OUR JOURNEY TO SUSTAINABLE GROWTH

Prior to our initial public offering (“IPO”) in September 2014 and subsequent separation from The Royal Bank of Scotland Group plc, our performance was well-behindhad fallen behind peers given balance sheet shrinkage and there had been underinvestment in strategic initiatives, technology and talent over a number of years. With the onboarding of Bruce Van Saun as our chief executive officer in October 2013, we outlined an aggressive turnaround plan focused on investing in infrastructure, products and talent, growing revenue and managing expenses in preparation for and following our initial public offering.

Over the past threefour years, we have executed well onaddressed many of the challenges we faced at our turnaroundIPO and have consistently demonstrated the ability to set a course, develop a plan, and execute well. Our strategies to drive improvement in performance across the Company have continued and at year end we had exceeded the medium-term return on tangible common equity (“ROTCE”) target we established in January 2018. We have met or exceeded analyst expectations for 1418 consecutive quarters. We have focused on growing the bank and investing in capabilities, consistently delivering positive operating leverage. This has resulted in improvements across earnings per share (“EPS”), ROTCE and efficiency ratio. We continue to deliver well for all stakeholders, with consistent progress for customers, colleagues and communities, and our regulatory position is solid. We believe we have turned the corner on performance and are now aiming for excellence, on our way towards becoming atop-performingIn addition, regional bank. We believe we have built a solid foundation with additional levers available to us for continued performance improvement.

2018Year-end Achievements

| | | | | | | | | | | | | | | | |

| | | January 2018

medium-

term targets | | 2018

GAAP

results | | 2018

Underlying

results* | |  | | 4Q18

GAAP

results | | 4Q18

Underlying

results* | | GAAP

improvement

since 3Q13 | | Underlying

improvement

since 3Q13* |

ROTCE* | | ~13-15% | | 12.9% | | 13.1% | | 13.8% | | 14.1% | | 9.5% | | 9.8% |

Efficiency ratio* | | ~mid 50%’s

range | | 59.1% | | 58.1% | | 59.7% | | 56.7% | | 8.8% | | 11.8% |

Generated net income available to common stockholders of $1.7 billion, up 3% from 2017 Year-end Strategic Achievementsand net income available to common stockholders on an Underlying basis* of $1.7 billion, up 32%

Grew diluted earnings per common share of $3.52 by 8% from 2017 and Underlying* diluted earnings per common share of $3.56 by 38%

Revenue growth of 7% versus prior year, or 8% on an Underlying basis* with just 4% expense growth

Positive operating leverage helped drive improvement in the efficiency ratio of 181 basis points from prior year and 183 basis points on an Underlying basis*

Achieved 14.1% ROTCE in the fourth quarter on an Underlying basis*. Full Year 2018 ROTCE improved by 59 basis points from prior year and 327 basis points on an Underlying basis*

We returned $1.5 billion to common stockholders in 2018, including dividends and share repurchases, up 31% from 2017

| IPO-based medium-term targets | | | 2017 GAAP results | | | 2017 Underlying results* | |

| | 4Q17 GAAP results | | | 4Q17 Underlying results* | | | GAAP improvement since 3Q13 | | | Underlying improvement since 3Q13* | |

ROTCE* | | 10.0% | | | | 12.3% | | | | 9.8% | | | | 19.9 | % | | | 10.4% | | | | 15.6% | | | | 6.1% | |

ROTA* | 1.0%+ | | | | 1.2% | | | | 0.9% | | | | 1.8 | % | | | 1.0% | | | | 1.3% | | | | 0.4% | |

Efficiency ratio* | ~60.0% | | | | 60.9% | | | | 60.0% | | | | 60.5 | % | | | 58.5% | | | | 8.0% | | | | 10.0% | |

•

| Generated net income available to common stockholders of $1.6 billion, up 59% from 2016 and Adjusted/Underlying basis* net income available to common stockholders of $1.3 billion, up 28%

| | •

| Improved ROTCE by 461 basis points from prior year and 219 basis points on an Adjusted/Underlying basis*

|

| | | | |

•

| Grew diluted earnings per common share of $3.25 by 65% from 2016 and Adjusted/Underlying basis* diluted earnings per common share of $2.58 by 34%

| | •

| We returned $1.1 billion to common stockholders in 2017, including dividends and share repurchases, up 70% from 2016

|

| | | | |

•

| Revenue growth of 9% versus prior year, or 10% on an Adjusted/Underlying basis* with expense growth of just 4%, or 3% on an Adjusted/Underlying basis*

| | •

| Strong CET1 ratio of 11.2% allows for attractive loan growth and continued capital returns to stockholders

|

| | | | |

•

| Positive operating leverage helped drive improvement in the efficiency ratio of 293 basis points from prior year and 396 basis points on an Adjusted/Underlying basis*

| | •

| Continued focus on delivering enhanced returns to stockholders through commitment to continuous improvement and positive operating leverage

|

| | | | |

Remain focused on delivering enhanced returns to stockholders through commitment to continuous improvement and positive operating leverage

|

*Key Performance Metrics (KPMs) are used by management to gauge our performance and progress over time in achieving our strategic and operational goals and also in comparing our performance against our peers. Underlying results, Adjusted results and Adjusted/Underlying results are considerednon-GAAP financial measures and exclude certain notable items, where applicable. Adjusted, Underlying and Adjusted/Underlying KPMs are considerednon-GAAP financial measures. For additional information on our use of KPMs and non-GAAP financial measures, see pages42-43 of our 2018 Annual Report on Form10-K, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Introduction—Key Performance Metrics Used by Management andNon-GAAP Financial Measures” and pages102-110 of our 2018 Annual Report on Form10-K, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Metrics,Non-GAAP Financial Measures and Reconciliations” of Part II, Item 7. See Appendix A to this proxy statement for calculations of KPMs and reconciliations ofnon-GAAP financial measures used herein. |

* 2019 Key Performance Metrics (KPMs) are used by management to gauge our performance and progress over time in achieving our

| CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARY |

strategic and operational goals and also in comparing our performance against our peers. Underlying results, Adjusted results

| |

and Adjusted/Underlying results are considered non-GAAP financial measures and exclude certain notable items, where

| |

applicable. Adjusted, Underlying and Adjusted/Underlying KPMs are considered non-GAAP financial measures. For additional

| |

information on our use of KPMs and non-GAAP financial measures, see pages 41-42 of our 2017 Annual Report on Form 10-K, in

| |

the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Introduction—Key

| |

Performance Metrics Used by Management and Non-GAAP Financial Measures” and pages 45-50 of our 2017 Annual Report on

| |

Form 10-K, in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key

| |

Performance Metrics, Non-GAAP Financial Measures and Reconciliations” of Part II, Item 7. See Appendix A to this Proxy

| |

Statement for calculations of KPMs and reconciliations of non-GAAP financial measures used herein.

| |

Beyond Our Financial Performance

SinceOur mission is to help our initial public offering,customers, colleagues and communities reach their potential. If we have also made significant progressdo this well, we will build long-term franchise value and stand out in howa crowded banking landscape. We are committed to balancing the need for investments that position us well for the future with the imperative that we run the Company:deliver consistent earnings growth and attractive returns. Our success through our turnaround phase gives us confidence in our future, as we seek to become atop-performing bank.

ExercisedWe continue to exercise strong financial discipline, with a mindset of continuous improvement that has delivered efficiencies to self-fund investments and strategic initiatives to better serve customers and grow revenues. We have utilized new technologies to deliver more effective service delivery at lower costs.

Disciplined executionagainstmajorWe’ve gained additional momentum on fee income growthinitiatives with expanded capabilitiesinkey feeincomebusinesses,includingCapital& GlobalMarkets, Mortgage,Wealth andTreasury Solutions.

We’ve delivered disciplined execution against enterprise-wide initiatives like our Tapping Our Potential (“TOP”) and Balance Sheet Optimization programs.

StrongWe’ve made strong progressonadvancingstrategiccapabilitiesusingdigitaltechnologiesand Fintech partnershipstocreatebetterexperiencesforourcustomers.

AttractingWe are committed to attracting high caliber talent in order to further strengthen the senior leadership team while developing existing leaders and talent.

ContinuedmomentumincreatingWe’ve enhanced our customer-centric culture, with a value-driven, customer centric culture. Our goal is to achieve a peer leading employee,peer-leading customer, colleague and community experience.

Further progress in buildingWe’ve continued to build a strong risk management culture, which has resulted in an improved control environment, as well as significant advancements inprogress on our regulatory agenda, including effectively remediatingmeeting heightened regulatory standards and terminating regulatory actions and receipt of expectations. We received anon-objection toour Comprehensive Capital Analysis and Review (CCAR)(“CCAR”) submissionforthethird fourth year inarow.

While we recognize there is much remaining to achieve, these milestones signify meaningful progress towardtowards becoming atop-performing bank. We believe we have the vision, strategy, vision,leadership, capabilities and talent to continue to deliver strong performance that meetsand to continue to meet rising stockholder expectations.

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – PROXY SUMMARY |

COMPENSATION HIGHLIGHTS

| | |

| |

Completion of Evolution from UK-Influenced Compensation Program

| | How Do We have completed our evolution from a UK-influenced compensation program under our previous ownership by RBS, to a compensation program designed to be consistent with US market and regulatory standards. This evolution has included the elimination of role-based allowances which rebalancedDetermine Compensation? • Overall funding for variable compensation and fixed pay (starting with compensation for the 2016 performance year), the negotiation of a new employment agreement with Mr. Van Saun in May 2016 more closely aligned to US practice, and the vesting of the final installment of converted RBS-granted equity in March 2017. |

| |

Executive Pay Mix Aligned with Stockholder Interests

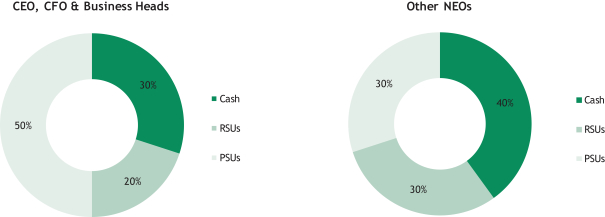

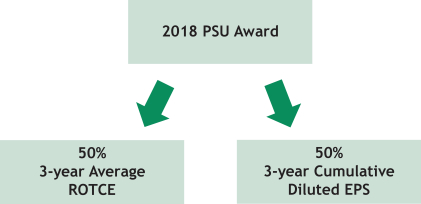

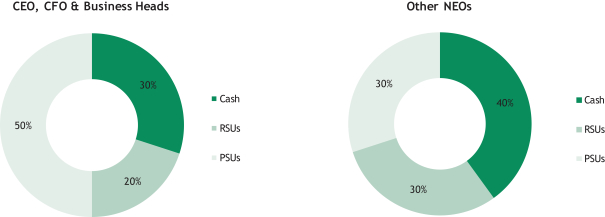

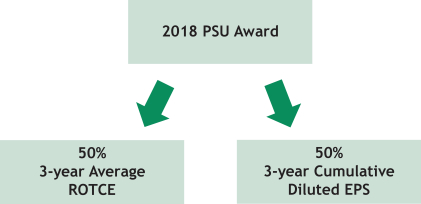

| Our executive pay mix is aligned with stockholder interests by delivering 60%-70% of variable compensation in the form of long-term awards. Of our long-term awards, 50%-70% are delivered in the form of performance stock units with a three-year performance period (with our CEO and most of our named executive officers receiving 70% of long-term awards in the form of performance stock units).

|

| |

| |

Bonus Funding Determined Based on Balanced Review of Company Performance

| The Compensation and Human Resources Committee (the “Compensation Committee”) determines overall bonus fundingdetermined based on a number of performance factors, including the Company’s financial performance,and risk performance, progress against strategic priorities, delivery to stakeholders,initiatives, performance relative to peers (including relative performance improvement), and funding as a percentage ofpre-tax,pre-incentive operating profit.

|

| |

Executive Compensation Decisions Consider Various Performance Dimensions, Including the Consideration of Risk Performance at Various Levels

| • The Board’s independent Compensation and Human Resources Committee (“Compensation Committee”) determines executive compensation based on an evaluation of Company, business/function and individual performance, through the use of a scorecard reflecting various performance dimensions. |

| | |

| |

| | How Do We Pay Our Executives? • Executive pay mix is aligned with stockholder interests by delivering60%-70% of variable compensation in the following dimensions: financialform of long-term awards. • 70% of long-term awards are granted in the form of performance stock units with a three-year performance period for our CEO, CFO, and overall business performance;the heads of our Commercial and Consumer businesses. |

| | |

| |

| | How Do We Address Risk? • The risk and control; customer outcomes; strategic initiatives; and development/leadershipperformance of employees. Ourour executives including our named executive officers, are also subject to an annual risk assessmentis assessed annually by our Chief Risk Officer and the results of whichthat assessment are considered by the Compensation Committee when making compensation decisions. in determining pay. |

| • Incentive plan governance requires approval by all control partners for plan changes (including risk, legal, human resources, and finance) and an independent risk review of our plans is conducted every three years (in addition to annual internal review). |

Pay Practices Demonstrate Good Governance

| • We believe our pay practices demonstrate our commitment to good governance, including but not limited to: •Clawback Process: We havemaintain a clawback process, wherebythrough which events having a material adverse impact on the Company are reviewed for potential impact on compensation.

|

| | |

| |

| | Why Should You Approve ourSay-on-Pay Vote? •Incentive Plan Review Process: Our Since separating from The Royal Bank of Scotland Group plc in 2015, we have aligned our compensation plans are subjectprogram with US compensation practices, and we remain committed to a robust governance process requiringcontinually evaluating our program relative to peer and best practices. • We believe our compensation program provides an appropriate balance of short-term and long-term compensation, designed to align our executive officers’ interests with those of stockholders. • Stockholders overwhelmingly approved the 2017 compensation of our named executive officers, with an approval for changes by all control partners (including risk, legal, human resources, and finance). The plans are subject to a risk review byrate of over 95% of votes cast on the Compensation Committee on an annual basis, and a risk review by an independent third party every three years. •No Single Trigger Payments: We do not provide for any single trigger severance payments upon a change of control, and do not offer tax gross-ups on executive benefits.proposal.

|

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

CORPORATE GOVERNANCEGOVERNANCE

PROPOSAL 1 - ELECTION OF DIRECTORS

Our Charter and Bylaws provide that the Board shall consist of not less than 5five nor more than 25twenty-five directors, excluding any directors elected by holders of preferred stock pursuant to provisions applicable only in the case of defaults under the terms of our preferred stock. The Board will fix the exact number of directors from time to time and has currently fixed the currentnumber at fourteen. The number of directors will be reduced to twelve following the retirement of Mr. Di Iorio and Mr. Ryan effective at twelve.the conclusion of the Annual Meeting. At each annual meeting, directors are elected to hold office for a term of one year expiring at the next annual meeting.

The Board has nominated twelve of the twelvefourteen directors currently serving on the Board for election at the Annual Meeting to serve until the 20192020 annual meeting or until their respective successors are duly elected and qualified. If any nominee is unable to serve as a director, the Board may reduce, by resolution, may reduce the number of directors or choose a substitute nominee. We are not aware of any nominee who will be unable to or will not serve as a director.

Our Bylaws provide for the election of directors by a majority of the votes cast in an uncontested election. This means that the twelve individuals nominated for election to the Board must receive more “FOR” than “AGAINST” votes (among votes properly cast in person, electronically or by proxy) to be elected. Abstentions and brokernon-votes are not considered votes cast for the foregoing purpose, and will have no effect on the election of nominees. Proxies cannot be voted for a greater number of persons than the number of nominees named. There is no cumulative voting. If you sign and return the accompanying proxy card, your shares will be voted for the election of the twelve nominees recommended by the Board unless you choose to vote against any of the nominees or abstain from voting. If any nominee for any reason is unable to serve or will not serve, proxies may be voted for such substitute nominee as the proxy holder may determine. If the election of directors is not an uncontesteda contested election, directors are elected by a plurality of the votes cast.

Our Bylaws also provide that directors may be removed, with or without cause, by an affirmative vote of shares representing a majority of the outstanding shares then entitled to vote at an election of directors. Any vacancy occurring on our Board and any newly created directorship may be filled only by a vote of a majority of the remaining directors in office.

Biographical information about the nominees for director, including information about their qualifications to serve as a director, is set forth below.

Nominees

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

Nominees

| | | | | | |

| | Bruce Van Saun | | Mark Casady

Age: 61 |

| | Chairman and Chief Executive Officer, Citizens Financial Group, Inc. Age: 60

| | Director Since: 2013 Committees: Executive (Chair); Equity |

|

|

| | |

| Retired Chairman and Chief Executive Officer, LPL Financial Holdings, Inc.

Age: 57

Director Since: 2014

Committees: Risk

|

Experience, Skills and Qualifications | | |

| • Experienced executiveExecutive in the financial services industry extensivewith over 30 years experience • Extensive financial background and service on the boards of other public companies • Additional role as our Chief Executive Officer brings management’s perspective to Board deliberations and provides valuable information about the status ofday-to-day operations |

| | Background Mr. Van Saun joined the Company as Chairman and CEO in October 2013 and also serves on the board of our primary subsidiary Citizens Bank, N.A. (“CBNA”). He previously served as The Royal Bank of Scotland Group plc Finance Director and was a member of its board of directors (from 2009 to 2013). From 1997 to 2008, Mr. Van Saun held a number of senior positions with The Bank of New York Mellon, including Vice Chairman and Chief Financial Officer. Earlier in his career, he held senior positions with Deutsche Bank, Wasserstein Perella Group and Kidder Peabody & Co. Mr. Van Saun currently serves on the board of directors of Moody’s Corporation (since 2016). He also serves on the boards of the Federal Reserve Bank of Boston (since January 2019) and the Bank Policy Institute (since October 2018). He is a member of The Clearing House supervisory board (since 2013), and serves on the boards of Jobs for Massachusetts and the Partnership for Rhode Island. Previous directorships held by Mr. Van Saun in both the United Kingdom and United States include Lloyds of London (from 2012 to 2016), the Federal Advisory Council (from 2016 to 2018) and the National Constitution Center (from 2015 to January 2019). Mr. Van Saun received a B.S. in Business Administration from Bucknell University in 1979 and an M.B.A. in Finance and General Management from the University of North Carolina in 1983. |

|

|

|

|

| | | | | | |

| | Mark Casady Retired Chairman and Chief Executive Officer, LPL Financial Holdings, Inc. | | Age: 58 |

| Director Since: 2014 Committees: Risk |

| Experience, Skills and Qualifications | | |

| • Compliance and risk experience as an executive in the financial services industry and service on the board of governors of Financial Industry Regulatory Authority (FINRA) • Expertise in the area of wealth management and brokerage, including experience as retiredwhile Chairman and Chief Executive Officer of LPL Financial Holdings, Inc. |

| • Knowledge of data management and analysis through his role at Vestigo Ventures and technology and innovation through his service on the board of Eze Software Group and data management and analysis through his role at Vestigo Ventures |

Background

Before joining the Company as Chairman and CEO, Mr. Van Saun served as The Royal Bank of Scotland Group plc Finance Director and was a member of its board of directors from October 2009 to October 2013. From 1997 to 2008, Mr. Van Saun held a number of senior positions with The Bank of New York and later The Bank of New York Mellon, including Vice Chairman and Chief Financial Officer. Earlier in his career, he held senior positions with Deutsche Bank, Wasserstein Perella Group and Kidder Peabody & Co. In all, Mr. Van Saun has more than 30 years of financial services experience. Mr. Van Saun has also served on the boards of directors of our subsidiaries Citizens Bank, N.A. (“CBNA”) and Citizens Bank of Pennsylvania (“CBPA”) since October 2013. Mr. Van Saun joined the board of directors of Moody’s Corporation on March 1, 2016 and serves on the Audit and Governance and Compensation Committees. He also sits on the Federal Advisory Council and is a member of The Clearing House supervisory board, and serves on the boards of Jobs for Massachusetts, the Partnership for Rhode Island, and the National Constitution Center. Previous directorships held by Mr. Van Saun in both the United Kingdom and United States include Lloyds of London (from September 2012 to May 2016), Direct Line Insurance Group plc (from April 2012 to October 2013), WorldPay (Ship Midco Limited) (from July 2011 to September 2013) and ConvergEx Inc. (from May 2007 to October 2013). Mr. Van Saun received a B.S. in Business Administration from Bucknell University in 1979 and an M.B.A. in Finance and General Management from the University of North Carolina in 1983.

| | Background Mr. Casady is the retiredwas Chairman and Chief Executive Officer of LPL Financial Holdings, Inc (“LPL Financial”). Mr. Casady retired as LPL Financial CEOInc. until his retirement in early January 2017 and as non-executive chairman of the board in early March 2017. He joined LPL Financial in May 2002 as Chief Operating Officer in 2002, became President in April 2003 and Chairman and Chief Executive Officer in Decemberat the end of 2005. During his time there, he guided LPL to become a leading financial services organization that serves independent financial advisors, banks, and credit unions, and provides clearing services to broker/dealers at financial services companies. Before joining LPL Financial, in 2002, Mr. Casady was managing director of the mutual fund group for Deutsche Asset Management, Americas - formerly Scudder Investments which he joined in 1994. Prior to Scudder,In 2016, he held roles at Concord Financial Group, a start-up funded by Hambrecht & Quist that went public, and started his career at Northern Trust. Mr. Casady co-founded Vestigo Ventures in 2016 with a focuswhich focuses on financing start -ups in FinTech.FinTechstart-ups. He is general partner and chairman of the advisory board. He is also a member of Mr. Casady currently serves on the board of JobCase, Inc. (since 2018) and is Chair of Copal Tree brands (since November 2018). He previously served on the EZEboard of Eze Software Group and serves as an advisor(from 2013 to Jobcase, Inc. He is a former member of2018), the Financial Industry Regulatory Authority (FINRA) Board of Governors (from 2009 to 2014) and is former Chairman of the Insured Retirement Institute. Mr. Casady hasHe also servedserves on the boardsboard of our subsidiaries CBNA and CBPA since June 2014. primary subsidiary CBNA. Mr. Casady received a B.S. from Indiana University and his M.B.A. from DePaul University. |

|

|

|

|

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

| | | | | | | | |

| | Christine M. Cumming | | Anthony Di Iorio

|

| Retired First Vice President and Chief Operating Officer, Federal Reserve Bank of New York | | Age: 6566 Director Since: 2015 Committees: Risk | |

|

| |

| |

| | | | | |

| Retired Chief Financial Officer, Deutsche Bank AG

Age: 74

Director Since: 2014

Committees: Audit; Nominating & Corporate Governance

|

Experience, Skills and Qualifications | | | | |

| • Seasoned bank regulatory executive with over 35 years at the Federal Reserve Bank of New York (“FRBNY”), including serving as First Vice President and Chief Operating Officer with the Federal Reserve Bank of New York • Extensive background in risk management, technology, monetary policy and bank supervision • Experience in crisis management as chair of the Cross-Border Crisis Management Group for the Resolution Steering Group of theG-20’s Financial Stability Board | | |

| | Experience, Skills and Qualifications

• Experienced executive in the financial services industry, including serving as Chief Financial Officer and board member of Deutsche Bank

• Extensive financial and accounting background and service on the boards of other public companies

|

Background Until her retirement in June 2015, Ms. Cumming was First Vice President of the Federal Reserve Bank of New York (“FRBNY”), theFRBNY, its second highest ranking officer, in the FRBNY, and served as its Chief Operating Officer, as well as an alternate voting member of the Federal Open Market Committee. Prior to holding that position, Previously, Ms. Cumming was executive vice presidentExecutive Vice President and director of research with responsibilityDirector for the Research and Market Analysis Group. Previously, she served asGroup and senior vice president for the Bank Supervision Group responsible for the Bank Analysis and Advisory and Technical Services Functions in the Bank Supervision Group. In 1992, she was appointed vice president and assigned to Domestic Bank Examinations in Bank Supervision.Functions. She also was active in the work of the Basel Committee, including as co-chair of the Risk Management Group and chair of the task forces on supervisory matters for the Joint Forum, made up of banking, securities and insurance regulators. From 2011 to April 2015, Ms. Cumming chaired the Cross-Border Crisis Management Group, which coordinated recovery and resolution planning for large, global financial institutions for the Resolution Steering Group of theG-20’s Financial Stability Board. Ms. Cumming joined the FRBNY’s staff in September 1979 as an economist in the International Research Department, and later in the FRBNY’s International Capital Markets staff. Ms. Cumming alsocurrently serves on the board of American Family Insurance Mutual Holding Company which she joined in(since 2016), MIO Partners, Inc. (since February 20162018) and the Financial Accounting Foundation (since 2016) and teaches part time at Colombia University’s SIPAUniversity and Rutgers University. She has also servedserves on the boardsboard of our subsidiaries CBNA and CBPA since October 2015. primary subsidiary CBNA. Ms. Cumming holds both a B.S. and Ph.D in economics from the University of Minnesota. | Background

Mr. Di lorio began his career at Peat Marwick (KPMG) where he worked in the firm’s Financial Institutions Practice in New York and Chicago. After leaving Peat Marwick, he worked for several leading financial institutions, including as Co-controller of Goldman Sachs, Chief Financial Officer of the Capital Markets business of NationsBank (Bank of America), Executive Vice President of Paine Webber and Chief Executive Officer of Paine Webber International. He joined Deutsche Bank in Frankfurt in 2001 and later became Chief Financial Officer and a member of its board of directors and group executive committee. After retiring from Deutsche Bank in 2008, he served as senior adviser to Ernst & Young working with the firm’s financial services partners in the United Kingdom, Europe, the Middle East and Africa. Mr. Di lorio has also served on the boards of directors of our subsidiaries CBNA and CBPA since January 2014 and served as a director on the board of our former affiliate, The Royal Bank of Scotland Group plc from September 2011 to March 2014. Mr. Di Iorio received a Bachelor of Business Administration from lona College and an M.B.A. from Columbia University.

| |

William P. Hankowsky

| | Howard H. Hanna III

| |

| | |

| | |

| | |

| | | | | | | | |

| | | |

| | Age: 67 Director Since: 2006 Committees: Audit; Compensation | | |

| | Chairman, President and Chief Executive Officer, Liberty Property Trust Age: 66

Director Since: 2006

Committees: Audit;Compensation

| |

| Chairman and Chief Executive Officer, Hanna Holdings, Inc.

Age: 70

Director Since: 2009

Committees: Audit; Nominating & Corporate Governance

|

| |

| |

| | | | | |

| Experience, Skills and Qualifications | �� | | | |

| • Extensive business and management expertise, particularly in the real estate sector as Chief Executive Officer of Liberty Property Trust and as President of the Philadelphia Industrial Development Corporation • Service on the boards of other public companies and numerousnon-profit entities | | |

| | Experience, Skills and Qualifications

• Extensive business and management expertise, particularly in the real estate and mortgage origination sectors

• Compliance and regulatory experience serving on the board of directors of the Federal Reserve Bank of Cleveland’s Pittsburgh office

• Service on the boards of numerous non-profit entities and academic institutions

|

Background Mr. Hankowsky is the Chairman, President & CEO of Liberty Property Trust. He joined Liberty in January 2001 as Chief Investment Officer and was responsible for refining the company’s corporate strategy and investment process. In 2002, he was named President, and in 2003, was appointed Chief Executive Officer and elected Chairman of Liberty’s board of trustees. Prior to joining Liberty, Mr. Hankowsky served for 11 years as President of the Philadelphia Industrial Development Corporation. Mr. Hankowsky currently serves on the boards of Aqua America Inc. (since 2004), Delaware River Waterfront Corporation, Greater Philadelphia Chamber of Commerce, Philadelphia Convention and Visitors Bureau, Pennsylvania Academy of the Fine Arts, Philadelphia Shipyard Development Corporation and United Way of Greater Philadelphia and Southern New Jersey. He has also servedserves on the boards of directorsboard of our subsidiaries CBNA and CBPA since November 2006. primary subsidiary CBNA. Mr. Hankowsky received a B.A. in economics from Brown University. | | |

| | |

| | |

| | |

| | |

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

| | | | | | | | |

| | | | | | Age: 71 Director Since: 2009 Committees: Audit; Nominating & Corporate Governance | | |

| | Howard H. Hanna III Chairman and Chief Executive Officer, Hanna Holdings, Inc. | | |

| |

| |

| | | | | |

| Experience, Skills and Qualifications | | | | |

| • Extensive business and management expertise, particularly in the real estate and mortgage origination sectors • Compliance and regulatory experience serving on the board of directors of the Federal Reserve Bank of Cleveland’s Pittsburgh office • Service on the boards of other financial institutions including Equibank and National City Pennsylvania Bank | | |

| | Background Mr. Hanna is the Chairman and Chief Executive Officer of Hanna Holdings, Inc. He became, which is a sales associate in 1970real estate company providing real estate, mortgage, title and the General Manager of Howard Hanna Real Estate Services in 1974. Mr. Hanna became Chief Operating Officer of Howard Hanna Real Estate Services and its parent company, Hanna Holdings, Inc. when the company incorporated in 1979 and then became President in 1983 and Chief Executive Officer in 1990. Howard Hanna Real Estate Services, Inc. offers mortgage origination products and services in certain geographies and, in this capacity, competes with us in Pennsylvania, Ohio, Michigan, Virginia, West Virginia, North Carolina, New York and Maryland. insurance services. Mr. Hanna currently serves as the Chair of the Children’s Hospital of Pittsburgh Board of Trustees and is a member of the hospital’s Foundation Board and Finance and Investment Committee. Mr. HannaHe also serves on the boards of LaRoche College, the Katz Graduate School of Business Board of Visitors, the University of Pittsburgh, the University of Pittsburgh Medical Center Health System, the Diocese of Pittsburgh Finance Council and the YMCA of Greater Pittsburgh. From 2007 to 2012, he Previously, Mr. Hanna served on the board of directors of the Federal Reserve Bank of Cleveland’s Pittsburgh office. Mr. Hanna hasoffice (from 2007 to 2012). He also servedserves on the boards of directorsboard of our subsidiaries CBNA and CBPA since June 2009. primary subsidiary CBNA. Mr. Hanna received a B.S. from John Carroll University in 1969. | | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | | | | | Age: 72 Director Since: 2014 Committees: Audit; Compensation | | |

| | Leo I. (“Lee”) Higdon | | Charles J. (“Bud”) Koch

|

| Past President, Connecticut College Age: 71

Director Since: 2014

Committees: Audit;Compensation

| |

| Retired Chairman President and Chief Executive Officer, Charter One Bank

Age: 71

Director Since: 2004

Committees: Risk (Chair); Audit

|

| |

| |

| | | | | |

| Experience, Skills and Qualifications | | | | |

| • Experienced executive in the financial services industry, including serving as Managing Director and Vice Chairman of Salomon Brothers Inc. • Service on the boards of other public companies, including asnon-executive Chairman of Encompass Health Corporation and as lead director of Eaton Vance Corporation • Experience in academic institutions, including as Past President of Connecticut College, Dean of the Darden Graduate School of Business Administration at the University of Virginia | | |

| | Background Mr. Higdon was the President of Connecticut College from 2006 to 2013. He was the President of the College of Charleston from 2001 to 2006. Prior to that, he was the President of Babson College and the Dean of the Darden Graduate School of Business Administration at the University of Virginia. He spent over 20 years at Salomon Brothers Inc, holding various positions, including Managing Director and Vice Chairman. Mr. Higdon serves on the board of directors of Eaton Vance Corporation (since 2000) where he is currently lead director, and Encompass Health Corporation (since 2004) where he is currently thenon-executive Chairman. He serves on the board of Charleston Symphony Orchestra (since August 2016). Mr. Higdon also serves on the board of our primary subsidiary CBNA. Mr. Higdon received a B.A. in history from Georgetown University and an M.B.A. in Finance from the University of Chicago. | | |

| | |

| | |

| | |

| | |

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

| | | | | | | | |

| | Edward J. (“Ned”) Kelly III Former Chairman, Institutional Clients Group, Citigroup, Inc. | | Age: 65 | | |

| Director Since: 2019 | | |

| Committees: Compensation; Nominating & Corporate Governance | | |

| | | | | |

| Experience, Skills and Qualifications | | | | |

| • Extensive experience in the financial services industry in various roles including Vice Chairman, Chief Financial Officer at Citigroup, Inc. and General Counsel at J.P. Morgan • Service on the boards of other public companies including MetLife and CSX Corporation | | |

| | Background Mr. Kelly joined our Board on February 1, 2019. Until his retirement in 2014, he was Chairman of Citigroup Inc.’s Institutional Clients Group. He previously served as Chairman of Global Banking from April 2010 to January 2011, and as Vice Chairman of Citigroup from July 2009 to April 2010. He also served as Citigroup’s Chief Financial Officer during 2009, and was previously head of Global Banking and President and Chief Executive Officer of Citi Alternative Investments. Mr. Kelly currently serves on the board of MetLife and was chairman of the board of directors at CSX Corporation until January 2019. He previously served on the board of XL Catlin (from 2014 to 2018). He also serves on the board of our primary subsidiary CBNA. Mr. Kelly joined Citigroup in 2008 from The Carlyle Group, a private investment firm, where he was a managing director. Prior to joining Carlyle in 2007, he was a Vice Chairman at PNC Financial Services Group following PNC’s acquisition of Mercantile Bankshares Corporation in 2007. He was Chairman, Chief Executive and President of Mercantile from 2003 to 2007. Before Mercantile, he was at J.P. Morgan where he held various positions including General Counsel and Secretary and managing director within J.P. Morgan’s investment banking business. Prior to joining J.P. Morgan, Mr. Kelly was a partner at the law firm of Davis Polk & Wardwell, where he specialized in matters related to financial institutions. Mr. Kelly received his J.D. from the University of Virginia School of Law, in 1981 and A.B. from Princeton University in 1975. | | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | | | Charles J. (“Bud”) Koch | | Age: 72 Director Since: 2004 Committees: Risk (Chair); Audit | | |

| | Retired Chairman, President and Chief Executive Officer, Charter One Financial | | |

| |

| |

| | | | | |

| Experience, Skills and Qualifications | | | | |

| • Veteran executive in the financial services industry, particularly in the retail banking sector, including position as Chief Executive Officer of Charter One Financial • Regulatory experience from service on the board of the FHLBFederal Home Loan Bank (“FHLB”) of Cincinnati • Service on the boards of other public companies and academic institutions | | |

Background

From 2006 to 2013, Mr. Higdon was the President of Connecticut College. He serves on the board of directors of Eaton Vance Corporation (since 2000) where he is currently lead director, and Encompass Health Corporation (since 2004) where he is currently the non-executive Chairman. From 2001 to 2006, he was the President of the College of Charleston. Prior to becoming President of the College of Charleston, Mr. Higdon was the President of Babson College and the Dean of the Darden Graduate School of Business Administration at the University of Virginia. Mr. Higdon spent over 20 years at Salomon Brothers Inc, holding various positions, including Managing Director and Vice Chairman. In addition, Mr. Higdon previously served on the boards of directors of Bestfoods, Inc., Chemtura Corporation and Newmont Mining Corporation. Mr. Higdon currently serves on the board of Charleston Symphony Orchestra which he joined in August 2016. He has also served on the boards of our subsidiaries CBNA and CBPA since August 2014. Mr. Higdon received a B.A. in history from Georgetown University and a M.B.A. in Finance from the University of Chicago.

| | Background Mr. Koch is the retired Chairman and Chief Executive Officer of Charter One Financial and its subsidiary Charter One Bank (“Charter One”). He served as Charter One’s Chief Executive Officer from 1987 to 2004 and as its Chairman from 1995 to 2004, when the bank was acquired by The Royal Bank of Scotland Group plc. Mr. Koch has servedserves on the boards of directorsboard of our subsidiaries CBNA and CBPA since September 2004.primary subsidiary CBNA. He also served on the board of directors of our former affiliate, The Royal Bank of Scotland Group plc from(from 2004 until February 2009. to 2009). Mr. Koch has been a director of Assurant Inc. (AIZ) since August 2005, and is currently a member of the Assurant Finance and Risk Committee which he chaired from 2005 to 2014, as well as a member of itsand Compensation Committee. He has been a director of the Federal Home Loan Bank (“FHLB”) of Cincinnati since 1990.Committees. He was Chairman of the Boarda director of the FHLB of Cincinnati (from 1990 through 2018) and was Chairman of the board from 2005 to 2006, and currently serves on its Risk, Compensation, and Nomination and Governance Committees.2006. His long tenure on the FHLB of Cincinnati Board has beenboard was interrupted twice, for a total of three years, due to term limitations. Mr. Koch serves as a trustee of Case Western Reserve University, and he served as its Chairman of the Boardboard from 2008 to 2012. He is also a past Chairman of the Boardboard of John Carroll University. Mr. Koch is a Graduategraduate of Lehigh University with a B.S. in Industrial Engineering and earned aan M.B.A. from Loyola College in Baltimore, Maryland. | | |

Arthur F. Ryan

| | Shivan Subramaniam

| |

| | |

| | |

| | |

| CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

| | | | | | | | |

| | | | | | | | |

| | Terrance J. Lillis Retired Chief Financial Officer, Principal Financial Group, Inc. | | Age: 66 Director Since: 2019 Committees: Audit | | |

| |

| |

| | | | | |

| Experience, Skills and Qualifications | | | | |

| • Seasoned executive with 35 years experience in the financial services industry • Service as Chief Financial Officer of Principal Financial Group, Inc. • Experience in capital allocation, portfolio management and strategic transactions | | |

| | Background Mr. Lillis joined our board on February 1, 2019. Until his retirement in 2017, he was the Chief Financial Officer of Principal Financial Group, Inc. He joined Principal in 1982 as an actuarial student and held various senior actuarial, risk management and product-pricing roles through 2008 when he was appointed Chief Financial Officer. Mr. Lillis currently serves on the board of Mercy Medical Center Board of Directors and is Chair of the Simpson College Board of Trustees. He also serves on the Henry B. Tippie College of Business Advisory Board, the Diocese of Des Moine and Catholic Charities Finance Council and the board of Principal International-Mexico. Mr. Lillis also serves on the board of our primary subsidiary CBNA. He is a member of the American Academy of Actuaries and a Fellow of the Society of Actuaries. Mr. Lillis received a bachelor’s degree from Simpson College after serving in the U.S. Army in the Republic of Korea and an M.S. degree in actuarial science from the University of Iowa in 1982. | | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | | | Shivan Subramaniam Retired Chairman and Chief Executive Officer, and President, Prudential Financial, Inc. Age: 75

Director Since: 2009

Lead Director

Committees: Compensation(Chair);Nominating&CorporateGovernance; Executive

| |

| Retired Chairman, FM Global

| | Age: 6970 Director Since: 2005 Committees: Nominating & Corporate Governance (Chair); Risk; Executive | | |

| | |

| |

| |

| | | | | |

| Experience, Skills and Qualifications • Veteran executive in the financial services industry, including position as Chief Executive Officer of Prudential Financial, Inc.

• Extensive experience in the retail banking sector as President and Chief Operating Officer of Chase Manhattan Bank

• Service on the boards of other public companies

| | Experience, Skills and Qualifications

| | |

| • Extensive business and management expertise, including serving as Chairman and Chief Executive Officer of FM Global • Particularly expertiseExpertise in the Insurance sector with over 40 years industry experience • Service on the boards of directors of FM Global, Lifespan Corporation and LSC Communications | | |

Background

Mr. Ryan is the retired Chairman, Chief Executive Officer and President of Prudential Financial, Inc. (“Prudential”) After 13 years at Prudential, he retired as Chief Executive Officer and President in 2007 and he retired as Chairman in May 2008. Prior to joining Prudential in 1994, Mr. Ryan worked at Chase Manhattan Bank (“Chase Manhattan”) for 22 years. He ran Chase Manhattan’s worldwide retail bank between 1984 and 1990 and became President and Chief Operating Officer in 1990. Mr. Ryan has served on the boards of directors of our subsidiaries CBNA and CBPA since April 2009 and also served (from October 2008 to September 2013) as a director on the board of our former affiliate, The Royal Bank of Scotland Group plc. He also has served as a non-executive director of Regeneron Pharmaceuticals, Inc. since January 2003.

| | Background Mr. Subramaniam was Chairman of Factory Mutual Insurance Company, a commercial and industrial property insurer from 2002 until December 2017 and retired from the board in April 2018. He also served as President and Chief Executive Officer from 1999 until his retirement at the end of 2014. Previously, Mr. Subramaniamhe served as Chairman and Chief Executive Officer at Allendale Insurance, a predecessor company of FM Global. Elected president of Allendale in 1992, he held a number of senior-level positions in finance and management after joining the company in 1974. Mr. Subramaniam’s career spans nearly 40 years in the insurance industry. He has servedSubramaniam serves on the board of directors of FM Global since 1999, LSC Communications since(since October 20162016) and Lifespan Corporation since(since December 2006.2006). He is also a director of the Rhode Island Public Expenditure Council. Mr. Subramaniam hasHe also servedserves on the boards of directorsboard of our subsidiaries CBNA and CBPA since January 2005. primary subsidiary CBNA. Mr. Subramaniam received a bachelor’s degree in mechanical engineering from the Birla Institute of Technology, Pilani, India, and two master’s degrees—one in operations research from the Polytechnic at New York University, and another in management from the Sloan School of Management at the Massachusetts Institute of Technology. | | |

Wendy A. Watson

| | Marita Zuraitis

| |

| | |

| | |

| | |

| CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

| | | | | | | | |

| | Wendy A. Watson Retired Executive Vice President, Global Services, State Street Bank & Trust Company | | Age: 6970 Director Since: 2010 Committees: Audit(Chair);

Compensation;Risk | | |

| |

| |

| | | | | |

| |

| Director, President and Chief Executive Officer, The Horace Mann Companies

Age: 57

Director Since: 2011

Committees: Risk

|

Experience, Skills and Qualifications | | | | |

| • Experienced executive in the financial services industry and extensive financial background, including serving as Executive Vice President, Global Services for State Street Bank & Trust Company • Fellowship with the National Association of Corporate Directors and credentials as a CPA and Certified Fraud Examiner • Advanced Professional Director Certification from the American College of Corporate Directors, a public company director education and credentialing organization | | |

| |

| |

| | | | |

| | | | |

| �� | Experience, Skills and Qualifications

• Seasoned executive in the financial services industry, particularly in the insurance sector as Chief Executive Officer of The Horace Mann Educators Corporation

• Over 30 years of insurance industry experience

• Service on the boards of other companies and academic institutions

|

Background Until her retirement in 2009, Ms. Watson was the Executive Vice President, Global Services for State Street Bank & Trust Company which she joined in 2000. Previously, Ms. WatsonPrior to that, she was with the Canadian Imperial Bank of Commerce where she served as Head of the Global Private Banking and Trust business and President & Chief Executive Officer, CIBC Finance. She has also served as Chief Information Officer and as Head of Internal Audit for Confederation Life Insurance Company in Toronto. Ms. Watson began her career in the audit department of Sun Life Assurance Company in Canada. She has servedserves as a director of MD Financial Holdings (CMA Holdings) Canada since 2010, DAS Canada Insurance Company (a subsidiary of Munich Re) since 2010, the Independent Order of the Foresters Life Insurance Company since 2013(since 2013) and MD Private Trust, (aa subsidiary of MD Financial Holdings) since 2015. Ms. Watson’s years of board service also include Chair of the board of two of State Street Bank’s multi-national entities—State Street Syntel Private Ltd (India) and State Street Syntel Services Ltd (Mauritius)Holdings (since 2015). She currentlypreviously served on the boards of MD Financial Holdings (CMA Holdings) Canada and DAS Canada Insurance Company, a subsidiary of Munich Re (from 2010 to 2018). She serves on the Community Service Committee of Boston Children’s Hospital and the Advisory Board of Empathways. Ms. Watson has also servedserves on the boards of directors of our subsidiaries CBNA and CBPA since October 2010. In addition to her corporate directorship roles, Ms. Watson is also currently a member of the Editorial Board of the “Intelligent Outsourcer” Journal and has served as a member of the board of directors of the Women’s College Hospital and the Women’s College Hospital Foundation in Toronto. our primary subsidiary CBNA. Ms. Watson is a magna cum laude graduate of McGill University in Montreal with a Bachelor of Commerce degree with majors in Accounting and Law. | | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | | | Marita Zuraitis Director, President and Chief Executive Officer, The Horace Mann Companies | | Age: 58 Director Since: 2011 Committees: Risk | | |

| | |

| |

| | | | | |

| Experience, Skills and Qualifications | | | | |

| • Seasoned executive in the financial services industry including experience as Chief Executive Officer of The Horace Mann Educators Corporation • Expertise in the Insurance sector with over 30 years industry experience • Service on the boards of other companies and academic institutions | | |

| | Background Ms. Zuraitis is Director, President and Chief Executive Officer of The Horace Mann Educators Corporation. Prior to joining Horace Mann in May 2013, Ms. Zuraitisshe served as Executive Vice President and a member of the Executive Leadership Team for The Hanover Insurance Group, Inc. While at The Hanover Insurance Group, Ms. Zuraitis served as President, Property and Casualty Companies, responsible for the personal and commercial lines of operation at Citizens Insurance Company of America, The Hanover Insurance Company and their affiliates, a position she held since 2004. Prior to 2004,Previously, she was President and Chief Executive Officer, Commercial Lines for The St. Paul Travelers Companies. Previously, she held underwriting and field management positions with United States Fidelity and Guaranty Company and Aetna Life and Casualty. Ms. Zuraitis has over 30 years of experience in the insurance industry. She has servedserves as a member of the board of trustees for the American Institute for Chartered Property and Casualty Underwriters, and has been a member of the executive and the compensation committees since June 2009. Ms. Zuraitis has2009, currently serving as vice chair. She also servedserves on the boardsboard of directors of our subsidiaries CBNA and CBPA since May 2011. Sheprimary subsidiary CBNA. Ms. Zuraitis is a past Chairpersonchair of the board of trustees for NCCI Holdings, Inc., a provider of workers’ compensation data analytics based in Boca Raton, Florida and a past member of the board of Worcester Academy in Worcester, Massachusetts. Ms. Zuraitis is a graduate of Fairfield University and completed Advanced Executive Education Program at the Wharton School of Business and the Program on Negotiations at Harvard University. | | |

| | |

| | |

| | |

| | |

2019 | CITIZENS FINANCIAL GROUP, INC. PROXY STATEMENT – CORPORATE GOVERNANCE |

BOARD GOVERNANCEAND OVERSIGHT

The following sections provide an overview of our board governance structure and processes. Among other topics, we describe how we select directors, how we consider the independence of our directors and key aspects of our Board operations.

Corporate Governance Guidelines, Committee Charters and Code of Business Conduct and Ethics

Our Board has adopted Corporate Governance Guidelines which set forth a flexible framework within which our Board, assisted by Board committees, directs our affairs. The Corporate Governance Guidelines address, among other things, the composition and functions of the Board, director independence, Board and Board committee evaluations, compensation of directors, management succession and review, Board committees and selection of new directors.

Our Corporate Governance Guidelines are available on the corporate governance section of our investor relations website at www.citizensbank.com/investor-relations.

The charters for each of the Audit, Compensation, Nominating and Corporate Governance, Risk and Executive Committees are also available on the corporate governance section of our investor relations website at www.citizensbank.com/investor-relations.

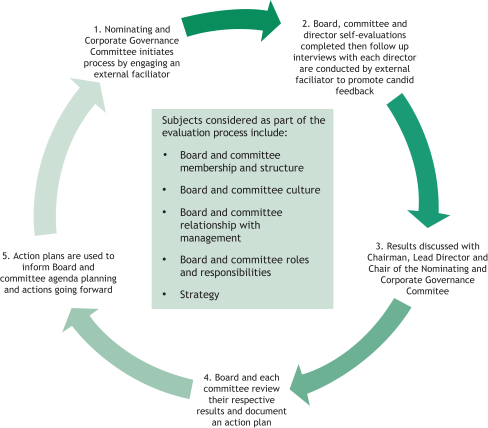

Our Board has also adopted a Code of Business Conduct and Ethics (the “Code”), which sets forth key guiding principles concerning ethical conduct and is applicable to all of our directors, officers and employees. The Code addresses, among other things, conflicts of interest, protection of confidential information and compliance with laws, rules and regulations, and describes the process by which any concerns about violations should be reported.